NCERT Solutions of Economics for Class 10 Chapter 3 Money and Credit

IN-CHAPTER QUESTIONS

Let’s Work These Out

Question.1. How does the use of money make it easier to exchange things?

Answer. With the use of money, the need for double coincidence of wants and the difficulties of the barter system have ended. In this way, the use of currency facilitates the exchange of goods. Example – A wheat seller wants to buy shoes in exchange for wheat. In the barter system, it would be difficult for him to find such a person who would take wheat from him and give him shoes in return, but the use of currency would solve his problem. Now the wheat seller will get money by selling wheat and with that money he will be able to buy shoes.

Question.2. Can you think of some examples of goods / services being exchanged or wages being paid through barter?

Answer. Under India, most of the goods and services are exchanged or wages are paid through barter in rural areas. In rural areas, exchange of grains is done directly without the use of money. Similarly, wages to agricultural laborers are generally paid in kind rather than in cash. This item can be wheat, rice, millet etc. any other food grains.

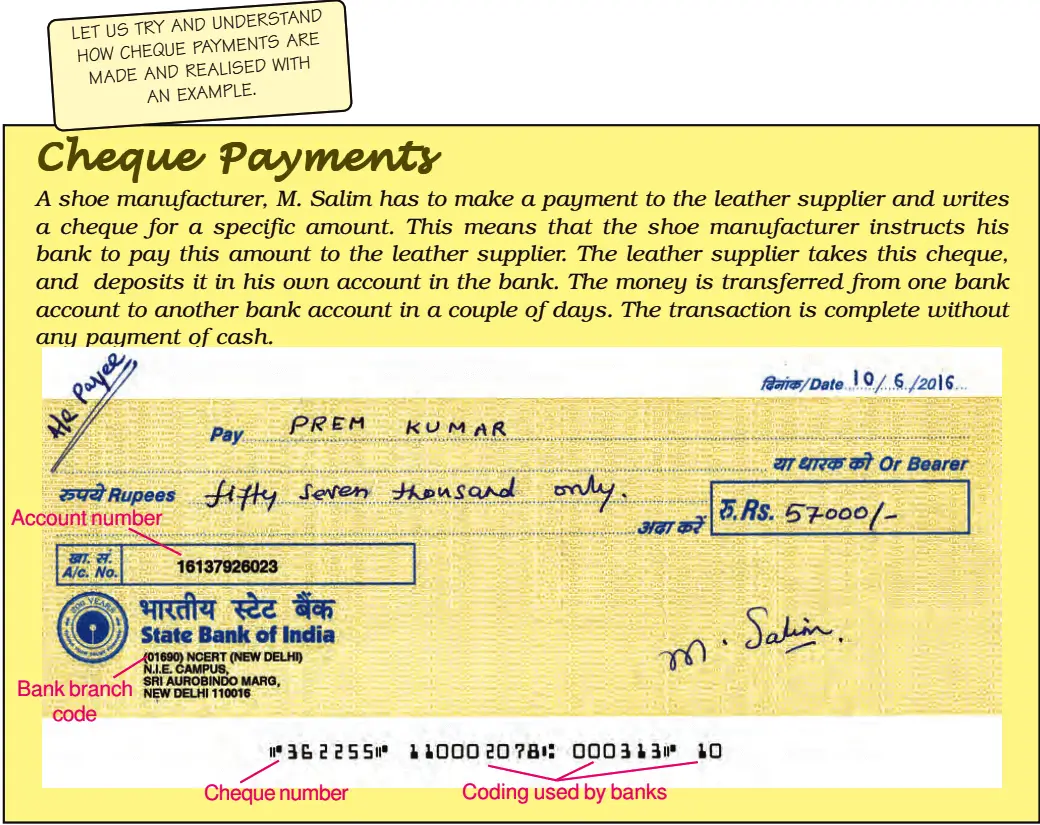

Let us Try and Understand How Cheque payments are made and Realised with an example.

Let’s Work These Out

Question.1. M. Salim wants to withdraw Rs 20,000 in cash for making payments. How would he write a cheque to withdraw money?

Answer. First of all M. Salim will write the date in the space provided in the cheque. He will himself order the payment to the bank. He will also write ‘twenty thousand only’ against the printed word ‘Rupees’ in the check and enter the amount and account number i.e. ₹ 20,000/- and 20019162063 respectively in the boxes provided. M. Salim will sign the check on the bottom right corner, after that he will take that check and deposit it at the bank’s withdrawal counter and get the money from the cashier.

Question.2. Tick the correct answer. After the transaction between Salim and Prem,

(i) Salim’s balance in his bank account increases, and Prem’s balance increases.

(ii) Salim’s balance in his bank account decreases and Prem’s balance increases.

(iii) Salim’s balance in his bank account increases and Prem’s balance decreases.

Answer. After the transaction between Salim and Prem, Salim’s balance in his bank account decreases and Prem’s balance increases.

Question.3. Why are demand deposits considered as money?

Answer. Demand Deposit is payable by way of cheque or money withdrawal slip. That’s why demand deposits are considered as money.

Question.4. What do you think would happen if all the depositors went to ask for their money at the same time?

Let’s Work These Out

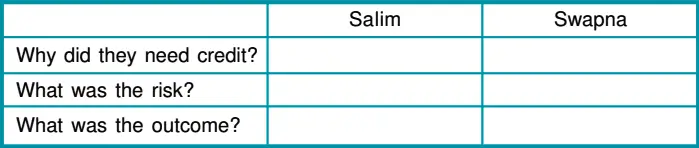

Question.1. Fill the following table :

Answer.

| Salim | Swapna | |

|---|---|---|

| Why did they need credit? | To procure raw material and meet other expenses | To meet the expenses of farming. |

| What was the risk? | If he did not provide the shoes within a month, the order received by him would be considered terminated. | The crop could have been ruined. |

| What was the outcome? | He made a good profit by supplying 3,000 pairs of shoes on time. | Due to the failure of the crop, Swapna got trapped in the debt trap due to not being able to repay the loan on time. He had to sell a part of his land to pay off the loan. |

Question.2. Supposing Salim continues to get orders from traders. What would be his position after 6 years?

Answer. If M. Salim keeps getting orders from traders, then after 6 years his financial condition will be very good and he will earn maximum profit every year. He will gradually expand his production. In this situation, he will not need to take a loan from any institution or bank.

Question.3. What are the reasons that make Swapna’s situation so risky? Discuss factors – pesticides; role of moneylenders; climate.

Answer. Many reasons make the food situation risky, such as the outbreak of pests on crops, exploitation by moneylenders and weather conditions.

- Pesticides : Swapna takes a loan to buy pesticides. Because they are very expensive. Even after this, her groundnut crop gets destroyed due to the outbreak of insects and due to lack of income, she is unable to repay the old loans as well.

- Role of Moneylenders : Moneylenders lured Swapna into debt trap by giving loans at high interest rates as a result of which Swapna had to sell a piece of her land to repay the loan. This further reduced his agricultural holdings.

- Weather : Weather plays an important role in agricultural production. Bad weather dashed Swapna’s hopes and she remained poorer and poorer, her condition did not improve.

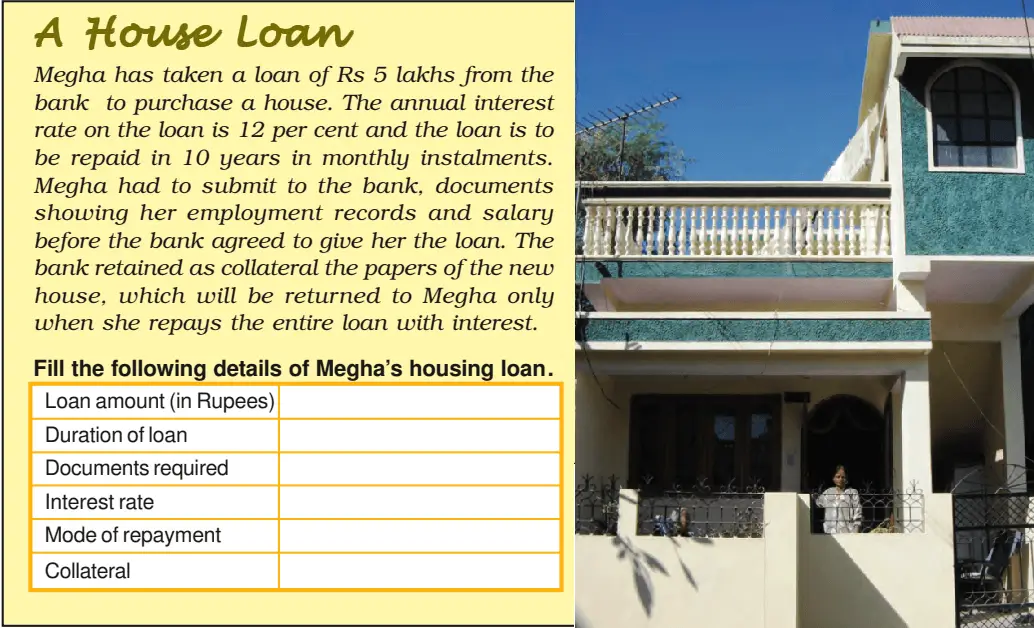

Question.4. Fill the details of Megha’s housing loan.

Answer. The details to be filled in the table are as follows:

| Loan amount (in Rupees) | 5 Lakh |

| Duration of loan | Salary Slips, Employment records |

| Duration of loan | Salary Slips, Employment records |

| Interest rate | 12% Per Annum |

| Mode of repayment | Monthly Installments through Cash or Cheque |

| Collateral | New House papers |

Lets Work These Out

Question.1. Why do lenders ask for collateral while lending?

Answer. At the time of lending, the lender asks for collateral or (guarantee) as security in return for the loan. He does this because in case the borrower fails to return the loan, the lender has the right to sell the collateral to get the payment.

Question.2. Given that a large number of people in our country are poor, does it in any way affect their capacity to borrow?

Answer. A large population of our country is poor. This definitely affects their credit taking ability as collateral has to be given in the form of a guarantee to get the loan. Poor people lack these assets which affects their ability to take loans.

Question.3. Fill in the blanks choosing the correct option from the brackets. While taking a loan, borrowers look for easy terms of credit. This means ___(A)___ (low/high) interest rate, _____(B)____ (easy/ tough) conditions for repayment, ___(C)___ (less/more) collateral and documentation requirements.

Answer. (A) Low, (B) Easy, (C) Less

Let’s Work These Out

Question.1. List the various sources of credit in Sonpur.

Answer. Following are the various sources of credit in Sonpur-

(i) Bank

(ii) landowner

(iii) Moneylender

(iv) Agricultural trader

(v) Agricultural Merchants Committee

Question.2. Underline the various uses of credit in Sonpur in the above passages.

Answer. Following are the lines with different uses of loan in the above paragraphs –

(i) According to Shyamal, he needs to borrow every season to cultivate his 1.5 acres of land.

(ii) Arun is one of the people of Sonpur who got a loan from the bank for farming.

(iii) There are several months in a year in which Rama has no work. He has to take out a loan for his daily expenses. He has to take a loan in case of sudden illness or to spend on some function in the family.

Question.3. Compare the terms of credit for the small farmer, the medium farmer and the landless agricultural worker in Sonpur.

Answer.

| Small Farmers | Medium Farmers | Landless Agricultural Workers |

|---|---|---|

| The rate of interest for obtaining loan for small farmers is 36% to 60% per annum. | The interest rate for the medium farmer is 8.5% per annum. | The interest rate for landless agricultural laborers is 60% per annum. |

| There is no need for pro loans and necessary forms to take this loan. | Supporting loans and necessary forms are required for this loan. | Supporting loans and necessary forms are not required. |

| This loan taken by the small farmer has to be repaid after the harvest. | This loan taken by the small farmer has to be repaid after the harvest. | The landless agricultural workers pays the loan by working with the landowner. |

| In addition to the rate of interest, the small farmer has to fulfill the condition of selling the crop to the trader. | The middle farmer does not have to fulfill any condition. | The landless agricultural laborer does not have to make any other resolution, he has to repay the loan only by working continuously |

Question.4. Why will Arun have a higher income from cultivation compared to Shyamal?

Answer. Arun will get more income from agriculture as compared to Shyamal. The reasons for this are as follows-

- Arun has 7 acres of land, while Shyamal has only 1.5 acres of land.

- Arun has taken a bank loan at the rate of 8.5 per cent per annum, while Shyamal has taken a loan from the moneylender of the village at the rate of 60 per cent per annum and from an agricultural trader at the rate of 36 per cent per annum. In such a situation, more of his money will be spent in liabilities.

- Arun can sell his agricultural crop to anyone and at any time at the price he wants, while Shyamal has to sell the agricultural crop to the trader as per his earlier promise. In such a situation, he will not be in a position to bargain so that there is profit.

Question.5. Can everyone in Sonpur get credit at a cheap rate? Who are the people who can?

Answer. Not everyone in Sonpur can get loans at affordable interest rates because availing bank loans at affordable interest rates requires a strong credit base which not everyone has. Those who can fulfill the requirements of the bank’s proloan base and necessary paper forms, only they can get loans from the bank at affordable interest rates. This situation is not the situation of all the people of Sonpur.

Question.6. Tick the correct answer.

(i) Over the years, Rama’s debt

(a) will rise.

(b) will remain constant.

(c) will decline.

(ii) Arun is one of the few people in Sonpur to take a bank loan because

(a) Other people in the village prefer to borrow from the moneylenders.

(b) banks demand collateral which everyone cannot provide.

(c) The interest rate on bank loans is the same as the interest rate charged by the traders.

Answer. (i) Over the years, Rama’s debt will rise.

(ii) Arun is one of the few people in Sonpur to take a bank loan because banks demand collateral which everyone cannot provide.

Question.7. Talk to some people to find out the credit arrangements that exist in your area. Record your conversation. Note the differences in the terms of credit across people.

Answer. Students can do this work with the help of their school teacher by studying the chapter deeply.

Let’s Work These Out

Question.1. What are the differences between formal and informal sources of credit?

Answer.

| Basis of Difference | Formal Sources | Informal Sources |

|---|---|---|

| Objective | The objective of formal sources of credit is profit making as well as social concern. | The objective of informal sources of credit is only for their own benefit. |

| Interest | Loans from these sources are available at low interest rates. | Loans from these sources are available at a higher rate of interest. |

| Conditions | Formal sources of credit do not impose undue conditions on the borrowers. | Informal sources of credit impose many stringent conditions on borrowers in addition to high interest rates. |

| Registration | Under the formal source, those sources of credit are included which are registered by the government. | Informal sources include those small and scattered units that often control the government. |

| Adherence to Rules | They have to follow government rules and regulations. | There are government rules and regulations for these too but they are not followed. |

| Committees | Banks and co-operative societies are included in the formal sources of credit. | Informal sources of credit include moneylenders, traders, employers, landowners, relatives and friends etc. |

| Functioning | The Reserve Bank of India monitors the functioning of formal sources of credit. | In informal sources, there is no such organization which monitors the activities of the lenders. |

Question.2. Why should credit at reasonable rates be available for all?

Answer. Loans should be available to all people at reasonable rates, so that people can easily take loans in any difficult situation. The loan helps the farmers to grow their crops. It helps the entrepreneurs to set up business units, complete the production on time and meet the working expenses of the production. This increases their income. Loans play a very important role in the development of the country.

Due to getting the loan at a higher rate of interest, most of the borrower’s income is spent in the interest payment of the loan. The borrower has very little income left for himself. Sometimes due to very high interest rates, the borrower remains burdened with debt throughout his life and lags behind in development.

Question.3. Should there be a supervisor, such as the Reserve Bank of India, that looks into the loan activities of informal lenders? Why would its task be quite difficult?

Answer. There should be a watchdog like the Reserve Bank of India to oversee the activities of informal lenders. His job will be tough because informal lenders are not approved by the government or any other recognized institutions. They are small and scattered and have personal relationship with the borrowers. Getting information about such informal lenders and taking action on them is a difficult task.

Question.4. Why do you think that the share of formal sector credit is higher for the richer households compared to the poorer households?

Answer. Richer households have a higher share of formal loans than poorer households because they are more educated than poorer households or because they know that banks offer loans at lower interest rates. Apart from this, rich families also have supporting loan documents and necessary paper forms to pledge in the bank in return for the loan received from the bank, while poor families lack all these.

TEXTBOOK EXERCISE

Question.1. In situations with high risks, credit might create further problems for the borrower. Explain.

Answer. In risky situations, the loan can create many problems for the borrower, we will understand it as follows. In our daily life, there are many transactions in many activities where credit is used in some form or the other. The main demand for loans in rural areas is for growing crops. Farmers take loan at the beginning of the season to grow the crop and repay the loan when the crop is ready. But if the crop is destroyed due to some reason, then the repayment of the loan becomes impossible. In such a situation, the farmer is forced to sell some part of his land. Thus, taking a loan in this risky situation creates many problems for the borrower and instead of increasing his earnings, his situation worsens.

Question.2. How does money solve the problem of double coincidence of wants? Explain with an example of your own.

Answer. Money exchange system is better system than barter system. The problem of double coincidence of wants is the most difficult problem of barter. If the things related to the necessity of two persons are not found, then exchange is impossible. Let’s understand from an example – If a shoe manufacturer needs wheat, then he must first find a wheat seller who not only has wheat but also needs shoes. This problem can be solved immediately by using currency.

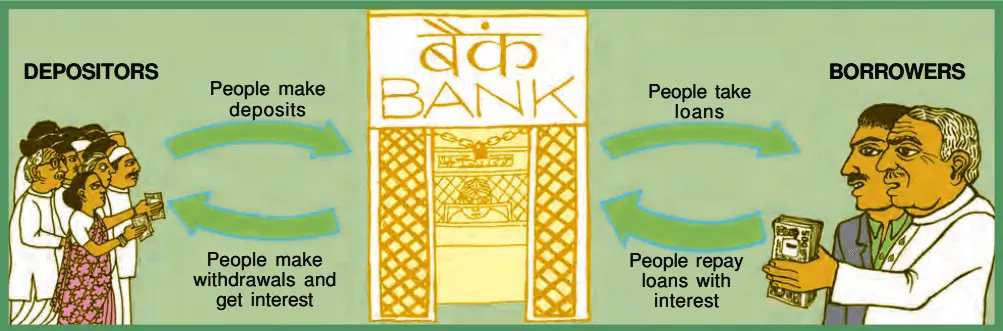

Question.3. How do banks mediate between those who have surplus money and those who need money?

Answer. Banks act as a special intermediary between people with surplus currency and those in need. People having surplus money deposit their money in banks by opening accounts in their own names. Banks accept these deposits and also pay interest on it. In this way, people’s currency remains safe with the banks and interest is also earned on it. People are also provided the facility to withdraw currency from it whenever they want. Banks keep only 15% of this deposit in the form of cash. Banks use the major part of the deposits to give loans. There is a great demand for loans for various economic activities. Banks give loans to people and charge interest on them.

Question.4. Look at a 10 rupee note. What is written on top? Can you explain this statement?

Answer. It is written on the top of the ten rupee note – Reserve Bank of India. This means that the Reserve Bank of India issues currency notes on behalf of the Central Government. According to Indian law, no person or institution is allowed to issue currency. In addition, the law legalizes the use of rupees as a medium of exchange. Rupee cannot be refused for payment in transactions in India.

Question.5. Why do we need to expand formal sources of credit in India?

Answer. The two main sources of India’s formal sector are

(i) banks and

(ii) cooperatives.

We need to increase the formal sources of credit in India due to the following reasons-

- Everyone can get a loan from the bank at a low rate of interest.

- The loan can be repaid in the next three years.

- Bank loans at low rates of interest increase the income of the borrowers and borrowers can easily repay it. Due to these facilities the borrower can take the loan for the second time as well.

- Formal sources of credit can keep people away from moneylenders, traders etc. who always find an opportunity to keep people in their clutches. The reason behind the organization of self-help groups may be indebtedness.

- Formal sources of credit can protect people from moneylenders, traders etc. who always find opportunities to trap people.

Question.6. What is the basic idea behind the SHGs for the poor? Explain in your own words.

Answer. There is an evolutionary basic idea behind the organization of Self Help Groups for the poor – Banks are not present in all the rural areas of India. Wherever they are, taking a loan from a bank is more difficult than taking a loan from a moneylender. Due to lack of credit base, poor families are unable to take loans from banks. That’s why poor people take loans from moneylenders who charge high rates of interest. To save the poor from this situation, efforts have been made to adopt new methods of lending. This is the idea behind the organization of self-sustaining groups. The government gives loans to these groups. It is also the responsibility of the group to repay this loan. Self-sustained clusters help the borrowers to overcome the problem of lack of credit base. They get this loan at a reasonable rate of interest for various purposes from time to time. Due to this the men and women of the village become self-reliant. Through the regular meetings of the group, people get a medium where they discuss and become aware of various social issues like health, nutrition and violence etc.

Question.7. What are the reasons why the banks might not be willing to lend to certain borrowers?

Answer. Banks are not ready to give loans to some borrowers, there are some special reasons for this –

(i) Some people do not have any property to pledge in the bank which they can keep as a guarantee.

(ii) Some people are not in a position to repay the loan in time.

(iii) Some people are already so much in the clutches of credit, that’s why the bank does not want to give more loans to those people.

Question.8. In what ways does the Reserve Bank of India supervise the functioning of banks? Why is this necessary?

Answer. (i) The Reserve Bank of India is the central bank of India, which oversees and controls the credit provided by the formal sector.

(ii) It supervises the affairs of the Bank in the following ways-

- The Reserve Bank of India monitors that banks carry a minimum cash portion of their deposits. Nowadays, banks in India keep 15% of the total deposits with them in the form of cash.

- The Reserve Bank also keeps an eye on the fact that banks are not only providing loans to profit making businessmen and traders, but are also providing loans to small farmers, small borrowers.

- From time to time, the banks have to give information to the Reserve Bank about how much loan and to whom they are giving loan and what their interest rates are.

Question.9. Analyse the role of credit for development.

Answer. Debt plays an important role in any country, state or individual development. In many activities of our life, there are many such deals where debt is used in some form or the other. By loan we mean an agreement where the lender provides money, goods or services to the borrower and in return takes a promise from the borrower to pay. The loan meets the working capital requirement of the producer. It helps him to meet the working expenses of production and timely completion of production. Through this he is able to increase his income. In this situation, credit plays an important and positive role.

Question.10. Manav needs a loan to set up a small business. On what basis will Manav decide whether to borrow from the bank or the moneylender? Discuss.

Answer. Manav also needs a loan to start a small business. Man or man decides from many things whether he should take loan from the bank or from the moneylender, understand through some points-

- He has to first understand the difference between the formal interest rate by contacting financial institutions and banks and then by contacting informal sources like moneylenders etc. their interest rate and other credit terms.

- Perusal or analysis of the terms of credit i.e. Tawezi work, loan basis, furnishing of guarantee etc.

- The mode of repayment or repayment of loan ie size of installment, periodicity (monthly, quarterly, half yearly or yearly) or lump sum payment at the end of fixed period (i.e. two years, three years).

- What is his own capacity to repay the loan?

- Once again end-to-end analysis of the entire information collected. Only after this the person will reach the decision that according to his repaying capacity, from which credit source he should borrow or take loan.

Question.11. In India, about 80 per cent of farmers are small farmers, who need credit for cultivation.

(A) Why might banks be unwilling to lend to small farmers?

(B) What are the other sources from which the small farmers can borrow?

(C) Explain with an example how the terms of credit can be unfavourable for the small farmer.

(D) Suggest some ways by which small farmers can get cheap credit.

Answer. (A) Banks hesitate to give loans to small farmers because they do not have any assets to pledge, and some of them are not in a position to repay the loan in time. Apart from this, some farmers are already in the clutches of debt, that’s why banks are not ready to give them additional loans.

(B) Moneylenders, employers, self-help groups and landlords etc. are other sources from which small farmers can take loans.

(C) Let’s understand from an example, if a person takes a loan from a landlord by mortgaging his land and is unable to pay the loan till the time expires, then in this case the landlord can get the loan amount paid by selling his land.

(D) Cheap loans can be made available to small farmers by self-help groups and banks. Because the loan obtained from them is at a lower interest rate than other sources, which can be easily repaid in 3 or 4 years.

Question.12. Fill in the blanks:

(i) Majority of the credit needs of the _________________households are met from informal sources.

(ii) ___________________costs of borrowing increase the debt-burden.

(iii) __________________ issues currency notes on behalf of the Central Government.

(iv) Banks charge a higher interest rate on loans than what they offer on __________.

(v) _______________ is an asset that the borrower owns and uses as a guarantee until the loan is repaid to the lender.

Answer. (i) Poor, (ii) Highest, (iii) Reserve Bank of India, (iv) Deposits, (v) Collateral

Question.13. Choose the most appropriate answer.

(i) In a SHG most of the decisions regarding savings and loan activities are taken by

(a) Bank

(b) Members

(c) Non-government organisation

(ii) Formal sources of credit does not include

(a) Banks

(b) Cooperatives

(c) Employers

Answer. (i) Members, (ii) Employers

ADDITIONAL PROJECT/ACTIVITY

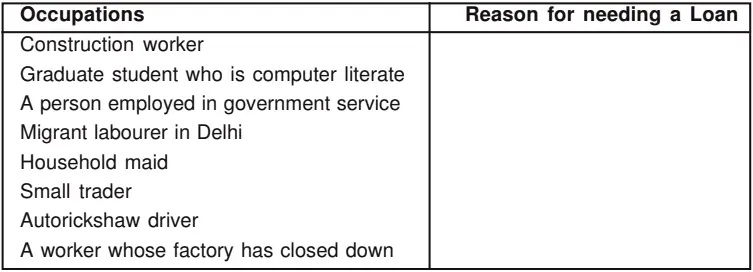

Project.1. The following table shows people in a variety of occupations in urban areas. What are the purposes for which the following people might need loans? Fill in the column.

| Occupations | Reasons for meeting a loan |

|---|---|

| Construction worker | To meet living expenses |

| Graduate student who is computer literate | To pursue higher education |

| A person employed in government service | For an offspring’s wedding |

| Migrant labourer in Delhi | To buy a house |

| Household maid | To meet living expenses |

| Small trader | To buy new machinery |

| Autorickshaw driver | To buy an autorickshaw |

| A worker whose factory has closed down | To meet living expenditure while still unemployed |

Next, classify the people into two groups based on whom you think might get a bank loan and those who might not. What is the criterion that you have used for classification?

Answer.

| Those who might get a bank loan | Those who might not get a bank loan |

|---|---|

| Graduate student who is computer literate | Construction worker |

| A person employed in government service | Migrant labourer in Delhi |

| Small trader | Household maid |

| Autorickshaw driver | A worker whose factory has closed down |